OTTAWA -- At a time when nothing seems the same or normal, Ottawa’s real estate numbers are consistent.

The growth is constant.

“Aside from a brief pause during the first two weeks after the initial Stay-At-Home order, the local real estate market has grown consistently over the last 36 months, including record-setting growth over the last year,” says Taylor Bennett of Bennett Property Shop Realty, (bennettpros.com) a regular contributor on CTV’s News at Noon.

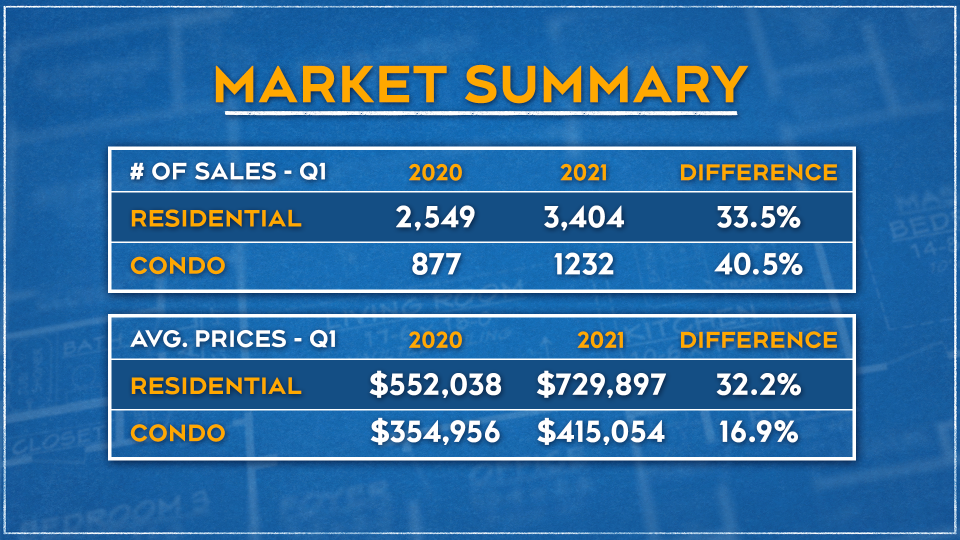

Inventory levels are still at record lows. Sales are at historic highs.

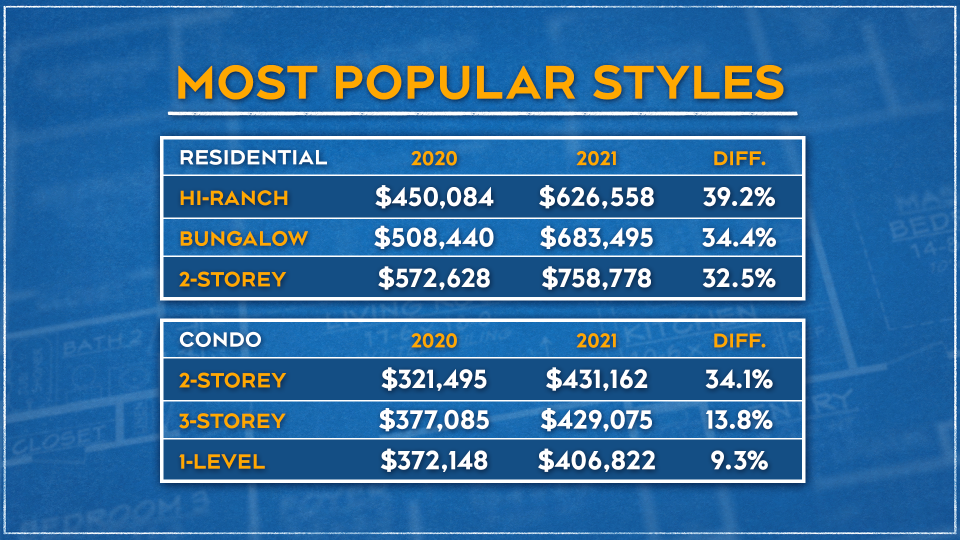

“Despite the inventory levels being almost 40 per cent lower than this time last year we have seen a substantial increase in sales with an average of 35 per cent growth,” Bennett says.

“With fewer available homes on the market than ever before combined with the number of sales increasing monthly, not only are housing prices at an all-time high, but properties are selling faster than ever.”

Bennett says in a seller’s market it’s is important to know your competition.

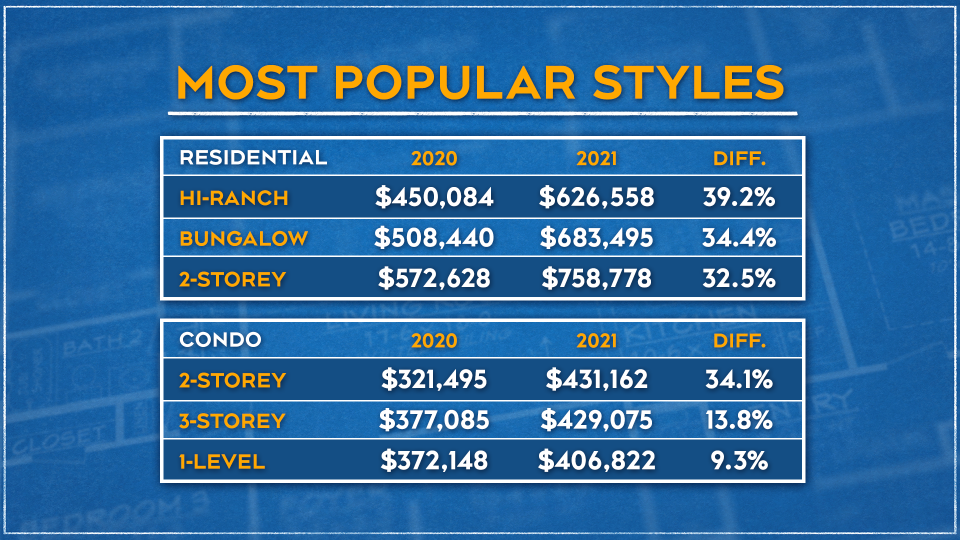

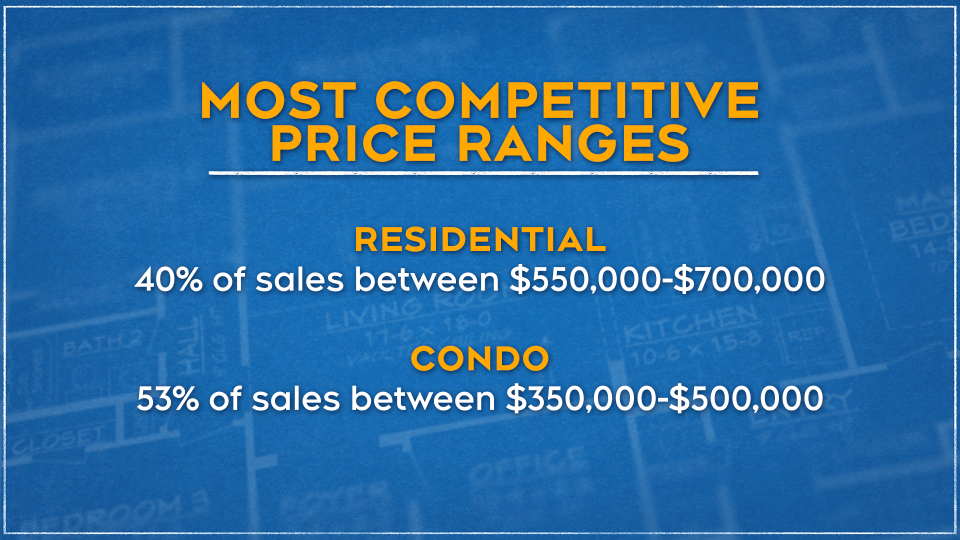

In residential sales, 40 per cent of buyers are looking for homes between $550,000 and $700,000.

For condos, the most competitive price range is between $350,000 and $500,000. Fifty-three per cent of buyers are shopping for those condominiums.

“Part of your preparation as a buyer should be to know what you're up against. Once you've got your mortgage pre-approval completed, you'll be able to see what type of homes are in your price range, but also how many other competitors you may be up against,” says Bennett.

“The more competitive the price range, the more preparation you need to do. Aside from the pre-approvals, savvy buyers should also consider pre-inspections, closing flexibility, et cetera. There are many factors at play aside from price and budget.”

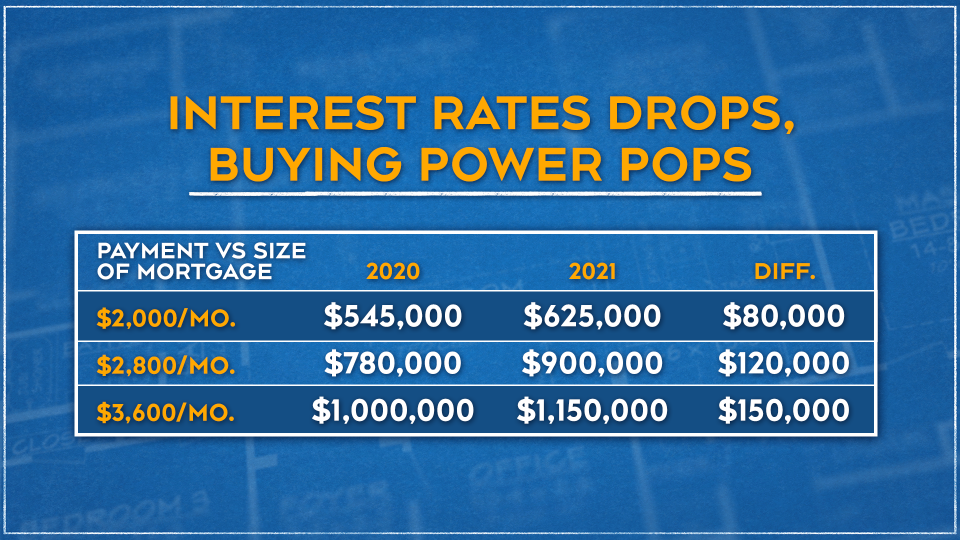

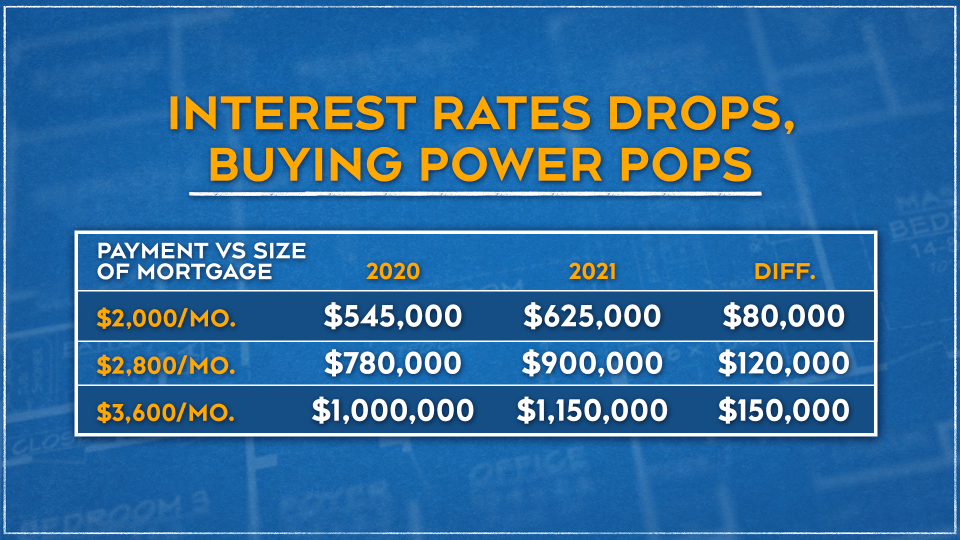

Interest Rates Drop, Buying Power Pops

“Compared to the beginning of 2020, buyers today have roughly 15 per cent more buying power, meaning their budgets have increased by 15 per cent while their monthly mortgage payment remains approximately the same,” says Bennett.

In the first quarter of 2020, a $2,000 per month mortgage meant your buyer power would fetch a price tag of $545,000. In 2021, a $2,000 monthly mortgage will buy a home worth $625,000.

“However, this may not be the case for long. A mortgage 'stress test' may be introduced shortly. While mortgage payments will still be based upon the posted interest rate, buyers' approval amount will be based upon a higher rate which will lower their purchasing budgets. In 2017, when a similar stress test was introduced, this created a buying frenzy before the test took effect,” explains Bennett.