Why is this village in Quebec facing a 370 per cent property tax hike?

Residents in the small Quebec village of Danford Lake may soon be priced out of their homes, as property valuations and taxes are set to skyrocket.

Located roughly an hour north of Ottawa, the village of Danford Lake – also known as Alleyn et Cawood – is home to just 300 people, with seasonal cottagers coming and going through the year. But earlier this year, homeowners in the area were notified that their property valuations would be increasing by 370 per cent in 2025, and along with it, the amount they pay in property taxes.

"Currently, my home is valued at $199,000. When this new comparative factor comes into effect in 2025, my home will be worth $738,000," says Sidney Squitti, a lifelong Danford Lake resident and current municipal councillor.

"So, my property taxes will increase from $2,500 annually to $8,000 annually."

Squitti says the drastic increase is due to the sale of more than 100 plots of empty land by property developers.

"[The evaluation of the plots of land] was at about $14,000. They sold for $40,000, $50,000, which has skewed the data for the values of the properties in our territory."

Isabelle Cardinal, director general for the municipality, says sales of the land were made in the midst of the pandemic, when many people were looking to leave larger cities in search of more rural settings.

"We have some people from Texas buying; from out west buying. It was very popular because this land became available shortly after Covid," Cardinal tells CTV News. "These developers, they listed land at these prices, and people were buying."

Cardinal, a resident of the village, says her current property taxes are around $3,000 annually. With the 370 per cent increase, her property taxes would rise to more than $12,000.

"Right now, my municipal evaluation is $280,000. And with the effect of the comparative factor, it's almost $1.1 million, and this is completely ridiculous," she says. "When my husband saw the tax bill, he said if somebody is willing to offer me $1.1 million for my house, we're packing our bags right now."

Squitti says the 2025 valuations are not an accurate representation of the village's homes, residents, or seasonal cottages.

She says the area is lacking infrastructure, such as sewers and a water treatment facility.

The small Quebec village of Danford Lake, also known as Alleyn et Cawood, is located roughly an hour north of Ottawa and is home to just 300 people. (Dylan Dyson/CTV News Ottawa)

The small Quebec village of Danford Lake, also known as Alleyn et Cawood, is located roughly an hour north of Ottawa and is home to just 300 people. (Dylan Dyson/CTV News Ottawa)

"We are one of the poorest municipalities in the MRC Pontiac. So, to be faced with an increase this substantial, it has the potential to wipe out the town. If people can't pay their taxes, we will become a ghost town."

Lifelong residents priced out of homes

The impact of such an increase is daunting to residents, many of whom are senior, retired, and have lived in Danford Lake much of their lives.

Linda Milford says despite not a single renovation to her home since 2000, her property value has soared.

"It's $86,700 now, and next year it'll be $320,790," the retired widow tells CTV News. "It's scary. I'm a senior citizen. I'm on a fixed income. Where am I going to get this extra money for taxes?"

Linda Milford, a Danforth Lake resident, peels apples while sitting on her porch in September. (Dylan Dyson/CTV News Ottawa)

Linda Milford, a Danforth Lake resident, peels apples while sitting on her porch in September. (Dylan Dyson/CTV News Ottawa)

Even with a projected valuation north of $320,000, Milford says she would never be able to sell her home for that much.

Many residents fear being forced to sell at lower prices due to looming property tax increases.

"My upstairs is unfinished, my basement floods, it's crazy," she says.

"They didn't do their homework before they bought," Milford says of the incoming buyers. "They paid way too much for their land."

Petitions and new bylaws

Squitti and Cardinal are two of about ten members that have formed a task force in the village. They started a petition earlier this summer to take to the provincial government in hopes of fighting the 370 per cent increase.

"We have a petition right now at the National Assembly," says Cardinal. "We are fighting the provincial process. We want to remove the impact of this comparative factor."

Squitti adds that if Danford Lake does not stand against the steep increase, it is a reality that could impact neighbouring municipalities, with more growth planned in the area.

"A lot of people are scared," says Cardinal. "I know that once people were getting their tax bill, we got a lot of calls at the municipal office because ratepayers were scared."

The petition can be found here and is open to signatures until Sept. 11.

Jane Toller, Warden for the MRC Pontiac, is optimistic the property rate increases will be re-evaluated soon, with the higher rates being applied only to those landowners who purchased the undeveloped properties.

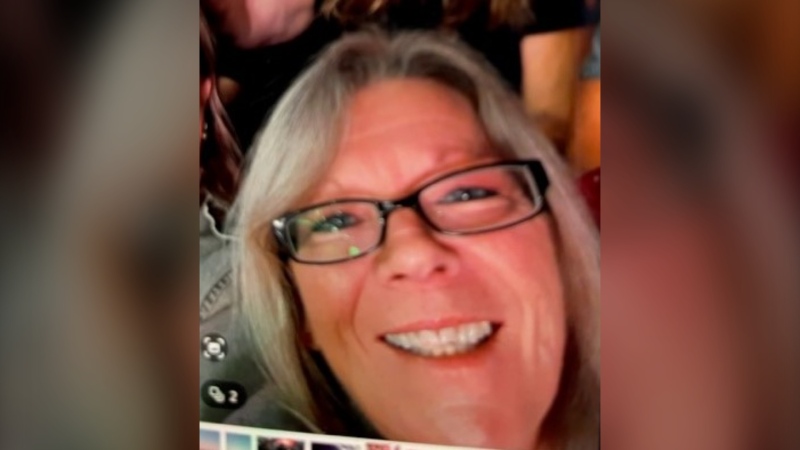

Jane Toller, Warden for the MRC Pontiac (Dylan Dyson/CTV News Ottawa)

Jane Toller, Warden for the MRC Pontiac (Dylan Dyson/CTV News Ottawa)

"On September 15th, they'll be able to go online and see actually what their taxation will be for their property. The 370 per cent is not going across the board for every home," says Toller.

Toller says she plans to introduce a bylaw to prevent this from happening to fellow municipalities in the Pontiac going forward.

"It is personally my hope that we can move this bylaw this fall," Toller said. "What I'd like to see is a new bylaw that could either remove the comparative factors or cap it."

Quebec government responds

The provincial government responded Tuesday to say that an increase in the value of a property will not necessarily imply an increase in property taxes, though it admits some residents could see an increase.

"In general, properties whose increase in property value is equivalent to the average growth rate in the value of the municipality's properties will not see a major increase in their tax bill. Properties whose property value has increased more significantly than the average could see their tax burden increase," the government said in a statement, originally in French.

"It should be noted that each municipality must balance its budget and therefore provide for revenues at least equal to the expenses listed in it. The budgetary choices of a municipality, including the determination of tax rates, are the prerogative of the municipal council."

A resident may file a request for review with the municipal assessor concerning an entry appearing on the property assessment roll, including the property value of a property, the province says. If no agreement is reached following the processing of this request for review, the person may then exercise an appeal before the Administrative Tribunal of Québec.

For larger tax increases, the province says the municipal government has options to ease the impact on taxpayers.

"In order to mitigate the variations in values resulting from the entry into force of a new property assessment roll, municipalities may spread these variations (increases and decreases) over the duration of the new roll, i.e. three years, for the purposes of establishing property taxes. This allows owners to gradually adjust to the increase in municipal taxes," a statement to CTV News Ottawa said. "Municipalities also have powers that allow them to diversify their sources of revenue in order to reduce the share coming from property taxes. For example, they can use municipal service pricing based on services received rather than property value. They can also set up alternative sources of revenue based on their regulatory fee power or their general taxing power."

CTVNews.ca Top Stories

Polls close for closely watched byelections in Montreal and Winnipeg

The NDP has a slight early lead in Winnipeg while remaining in a three-way race with the Liberals and the Bloc Québécois in Montreal as ballots continue to be counted in two crucial federal byelections.

GoFundMe cancels fundraiser for Ontario woman charged with spraying neighbour with a water gun

A Simcoe, Ont., woman charged with assault with a weapon after accidentally spraying her neighbour with a water gun says GoFundMe has now pulled the plug on her online fundraiser.

Freeland says she is 'not going anywhere' after Conservatives call her 'phantom finance minister'

Deputy Prime Minister Chrystia Freeland declared she is 'not going anywhere' when pushed by the Conservatives on Monday about her future as finance minister.

Suspect in apparent assassination attempt on Trump was near golf course for 12 hours

The man suspected in an apparent assassination attempt targeting Donald Trump camped outside a golf course with food and a rifle for nearly 12 hours.

Body recovered from B.C. lake after unclothed man leads investigators to crash site

Mounties are investigating a fatal crash north of Whistler, B.C., after an unclothed man who was found along the side of the road led police to a pickup truck submerged in a lake with one occupant still inside.

'Never seen anything like this': Humpback whale catches unsuspecting seal off Vancouver Island

A Vancouver Island nature photographer says he has never seen anything like what his camera captured on a recent whale-watching excursion off Victoria.

'Not that simple': Trump drags Canadian river into California's water problems

Republican presidential nominee Donald Trump promised "more water than you ever saw" to Californians, partly by tapping resources from a Canadian river.

Mortgage loan rules are changing in Canada

Finance Minister Chrystia Freeland has announced changes to mortgage rules she says are aimed at helping more Canadians to purchase their first home.

First teen sentenced in Kenneth Lee case gets 15 months probation

The first teenager to be sentenced in the death of a Toronto homeless man will not face further time in custody, and instead participate in a community-based program.