Reports suggest BMO received far more customer complaints in 2023 than other Canadian banks

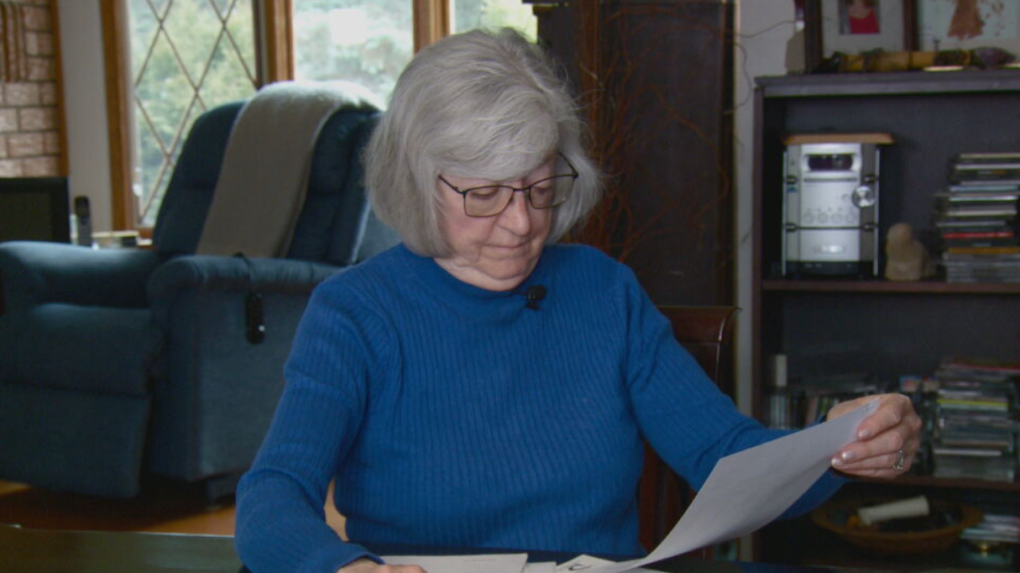

Carole Lemay’s story is one that has become increasingly common over the past three years.

- Sign up now for our daily CTV News Ottawa newsletters

- The information you need to know, sent directly to you: Download the CTV News App

She’s a former Bank of Montreal (BMO) customer who, back in September 2022, had $15,000 stolen from her bank account via Global Money Transfer.

After receiving a suspicious phone call, she drove straight to the bank and minutes later, was reassured that all of her money was still in her account and had not been stolen.

Lemay believes she followed all the proper steps and acted fast to warn the bank of suspected fraudulent activity, but it didn’t matter.

To be safe, Lemay was given a new debit and credit card, changed her password and her PIN.

But just minutes after her trip to the bank, her savings account was emptied and she has since been told she will not receive any compensation because BMO found that she must not have protected her banking information.

Lemay remains adamant that she has never shared account information with anyone. It remains unclear how the scammers gained access to her account. The information she was provided by the bank and the Ombudsman for Banking Services and Investments (OBSI) following their investigations did not provide any clarity in that regard.

Carole Lemay says $15,000 was stolen from her BMO account while she was at a local branch to report concerns that her account was compromised. BMO has said she failed to safeguard her banking information. (Austin Lee/CTV News Ottawa)

Carole Lemay says $15,000 was stolen from her BMO account while she was at a local branch to report concerns that her account was compromised. BMO has said she failed to safeguard her banking information. (Austin Lee/CTV News Ottawa)

But Lemay is far from alone.

According to the Ombudsman for Banking Services and Investments (OBSI) 2023 annual report, there was a 248 per cent increase in the number of opened banking cases in 2023 compared to 2022.

One reason for the uptick is changes to the Bank Act Consumer Protection Framework that came into effect on June 30, 2022, which changes the way banking complaints are handled.

“That has really changed the way that banks deal with consumer complaints and escalate them through their own systems and also the way that complaints get escalated to the ombudsman,” said Sarah Bradley, the ombudsman and CEO of the OBSI.

“There were some important structural changes that changed the volume of complaints moving through the system.”

However, a notable increase in fraud also had a significant impact on the spike.

“We’re seeing a very significant increase in fraud cases so those factors taken together are leading to the increase,” said Bradley.

“It’s been extremely busy for us. We’ve been keeping up with demand in terms of focusing on efficiency, and focusing on our resources to help Canadians who are reaching out to us. We received over 17,000 inquiries from the public last year and investigated over 3,000 complaints.”

Bradley tells CTV News there are about 55 people working on the OBSI’s investigative team and the organization plans to bring in more staff to help meet the growing demand.

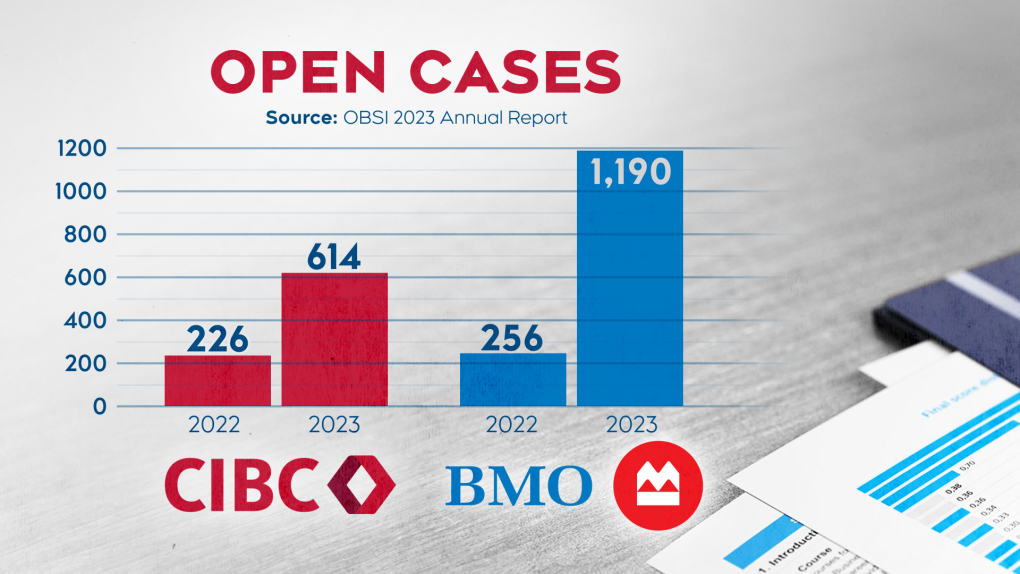

Last year, there were 2,388 ‘opened banking cases’ by the OBSI. Of those, 1,190 were from BMO customers. In 2022 there were 256 opened cases involving BMO.

Statistics from the Ombudsman for Banking Services and Investments (OBSI) show there was an uptick in BMO complaints last year. (CTV News Ottawa)

Statistics from the Ombudsman for Banking Services and Investments (OBSI) show there was an uptick in BMO complaints last year. (CTV News Ottawa)

Of the 1,190 cases opened by the OBSI based on BMO customer complaints, just 155 cases were ‘resolved to the satisfaction of the complainant.’

BMO and CIBC are the only two Canadian banks that are members of the OBSI. The organization reported 614 opened cases involving CIBC last year. In 2022, that bank saw 226 opened cases.

“Different banks have different practices and we see annual fluctuations from all financial institutions on a year to year basis,” said Bradley.

“We did see that BMO had a higher level of complaints than CIBC and I think that reflects some different practices and different approaches. I think though that every year there's going to be a different level of complaints for different sectors and different institutions. I would be cautious about reading too much into it.”

The ADR Chambers Banking Ombuds Office (ADRBO) reviews decisions from Canada’s other major banks such as TD, RBC and Scotiabank.

The ADRBO reports that RBC received 510 complaints, TD received 686 and Scotiabank received 460.

In a statement to CTV News, BMO says they "understand it is an extremly difficult situation for any victim of fraud."

The bank, quoting the OBSI's annual report, stresses that the number of cases reported is not necessarily a negative indication.

“When reviewing case numbers for each firm, it is important to note that a higher number of cases opened for a firm may not be a negative indication. Higher case volumes are generally unrelated to case outcomes and may simply be a result of the firm effectively informing consumers about OBSI’s services," a BMO spokesperson said in an email.

"Incidences of fraud are growing in advanced economies like Canada and impacting all industries. Criminals are using sophisticated methods to collect and harvest people’s personal information, and they can also gain access to personal electronic devices, including through the use of malicious links that infect personal phones and computers with malware. This is why it’s critical for customers to be vigilant in how they engage people calling or texting who claim to be representatives of their banks or other service providers."

The bank encourages customers to sign up for BMO Alerts to monitor their accounts for suspicious transaction activity.

No direct comparison between ombudsman complaint data

An OBSI spokesperson tells CTV News ‘new complaints’ at ADRBO are similar to 'opened cases.'

"However, there are important differences in how we record and report cases, so direct comparison may not be accurate.”

On Nov. 1, 2024, the OBSI will assume the role of the sole external complaints body for all federally regulated Canadian banks. Until then, there is no direct comparison available for anyone looking to see which banks have had the most consumer complaints elevated to the ombudsman.

Still, the available data suggests BMO customers are filing far more complaints than other major Canadian banks.

In an email, a BMO spokesperson tells CTV News: “In addition to our highly experienced teams, we partner with industry-leading and globally recognized fraud and technology experts to provide comprehensive investigation and mitigation support to help keep our customers safe.”

Cybercrime has become a 'commodity'

When it comes to bank fraud, the risks facing Canadians are on the rise and when someone’s personal information is impacted by a data breach, that data is often used by criminals to dupe people into opening themselves up to fraudulent activity.

Dustin Heywood is the chief architect of IBM X-Force, a cybersecurity “threat-centric" team of hackers, responders, researchers and analysts.

He says cybercrime has become a commodity.

“Cybercriminals will break into an organization, extract as much data as they can and then sell it to low-level street criminal effectively along with scripts saying here’s how to extract money,” he said.

“The customers’ data lives forever. There are data brokers going as far back as a decade ago so if a company gets breached that data never really goes away and it’s everything from your airline rewards program to local libraries to pizza shops and everything in between in addition to things like passwords.”

Heywood says many people have many passwords, but they do not have a password manager.

“Go out and get a password manager. The average person will have hundreds of passwords, and if they’re all the same, that’s a problem,” he said.

“The only password that’s any good is one that you can’t remember, is extremely long – at least 16 characters – and is randomly generated. There are systems out there that can guess hundreds of billions of passwords per second.”

Heywood also suggests people enable multi-factor authentication wherever possible, subscribe to credit monitoring and report any unauthorized transactions immediately, no matter how small.

CTVNews.ca Top Stories

W5 Investigates A 'ticking time bomb': Inside Syria's toughest prison holding accused high-ranking ISIS members

In the last of a three-part investigation, W5's Avery Haines was given rare access to a Syrian prison, where thousands of accused high-ranking ISIS members are being held.

'Mayday!': New details emerge after Boeing plane makes emergency landing at Mirabel airport

New details suggest that there were communication issues between the pilots of a charter flight and the control tower at Montreal's Mirabel airport when a Boeing 737 made an emergency landing on Wednesday.

BREAKING Supreme Court affirms constitutionality of B.C. law on opioid health costs recovery

Canada's top court has affirmed the constitutionality of a law that would allow British Columbia to pursue a class-action lawsuit against opioid providers on behalf of other provinces, the territories and the federal government.

Cucumbers sold in Ontario, other provinces recalled over possible salmonella contamination

A U.S. company is recalling cucumbers sold in Ontario and other Canadian provinces due to possible salmonella contamination.

Irregular sleep patterns may raise risk of heart attack and stroke, study suggests

Sleeping and waking up at different times is associated with an increased risk of heart attack and stroke, even for people who get the recommended amount of sleep, according to new research.

Real GDP per capita declines for 6th consecutive quarter, household savings rise

Statistics Canada says the economy grew at an annualized pace of one per cent during the third quarter, in line with economists' expectations.

Nick Cannon says he's seeking help for narcissistic personality disorder

Nick Cannon has spoken out about his recent diagnosis of narcissistic personality disorder, saying 'I need help.'

California man who went missing for 25 years found after sister sees his picture in the news

It’s a Thanksgiving miracle for one California family after a man who went missing in 1999 was found 25 years later when his sister saw a photo of him in an online article, authorities said.

As Australia bans social media for children, Quebec is paying close attention

As Australia moves to ban social media for children under 16, Quebec is debating whether to follow suit.