Here's how much you need to earn to buy a home in Ottawa this summer

Anyone looking to buy a home in Ottawa must have a six-figure income to purchase a property this summer.

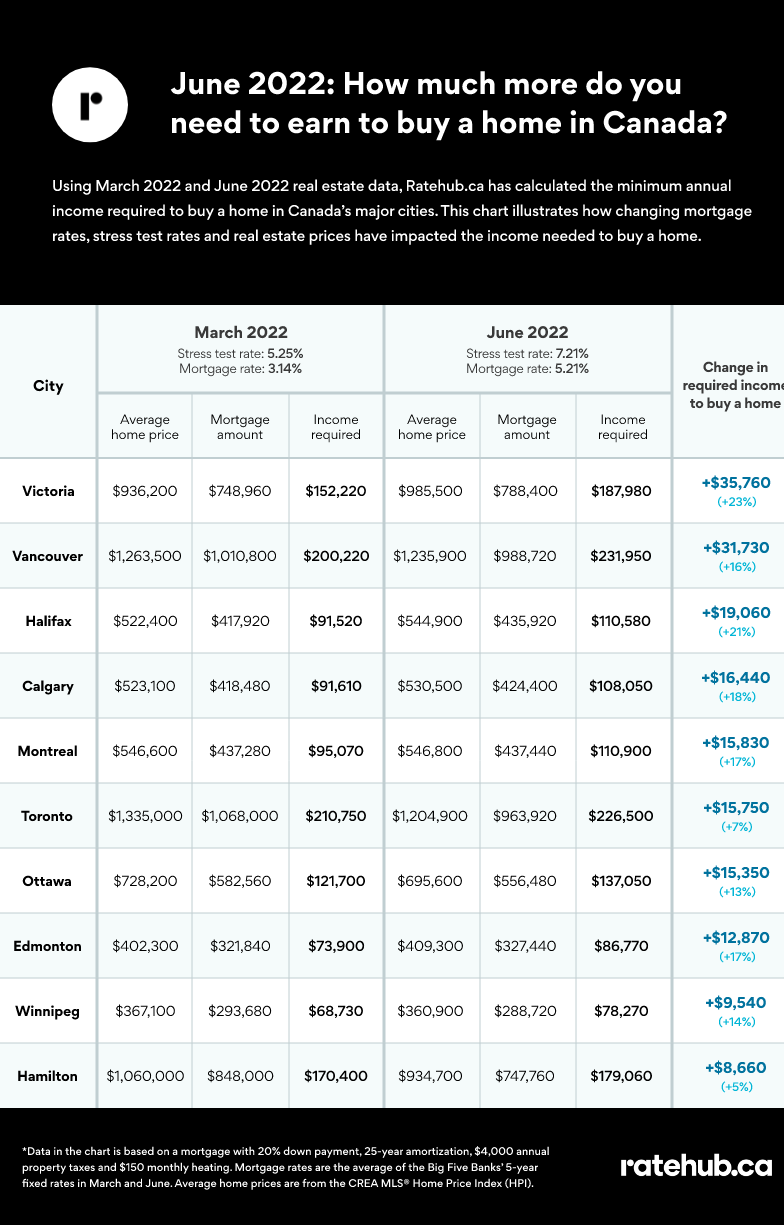

A new report from RateHub.ca shows homebuyers will need to earn at least $137,050 to meet the requirements to obtain a mortgage for the average priced home in the capital, with a 20 per cent down payment.

The report looked at the income required to purchase a home in Ottawa, with the average home price of $695,600 in June, and a mortgage of $556,480. The stress test rate was 7.21 per cent and the mortgage rate of 5.21 per cent.

Of the 10 Canadian cities looked at by RateHub.ca, Ottawa had the fifth-highest income requirement to purchase a home in June. Vancouver had the highest income requirement at $231,950, followed by Toronto ($226,500), Victoria ($187,980), and Hamilton ($179,060).

RateHub.ca says the income required to buy an average-priced home in Ottawa increased $15,350 from March to June.

The report from the mortgage rate comparison site says while the average price of a home in Ottawa was down in June from March, the income required to purchase a home remains higher due to stress test rates.

In March, homebuyers needed an income of $121,700 to purchase the average home in Ottawa of $728,000, according to RateHub.ca. The report notes the stress test rate and the mortgage rate were lower in March than in June.

"In every city, homebuyers require a lot more income to purchase the average home due to higher stress tests caused by increasing mortgage rates," RateHub.ca Co-CEO James Laird said in a statement.

Laird says home prices will need to drop significantly further to offset the effects of the higher stress test.

"Unless that happens, home affordability will continue to be negatively impacted by the current rising rate environment."

CTVNews.ca Top Stories

LIVE @ 1 p.m. PST / 4 p.m. EST Family, friends and fans to gather at memorial for former B.C. premier John Horgan

Thousands are expected to gather at an arena today in Colwood, B.C., to celebrate the life of former British Columbia premier John Horgan.

Candid photos of Syria's Assad expose a world beyond the carefully crafted and repressive rule

Bizarre and personal photos of ousted Syrian President Bashar Assad have surfaced from his abandoned residences, sparking ridicule among Syrians who only until recently were persecuted for criticizing his leadership.

Kennedy’s lawyer has asked the U.S. FDA to revoke its approval of the polio vaccine

U.S. president-elect Donald Trump has praised the polio vaccine as the 'greatest thing,' but a lawyer affiliated with Trump’s pick to lead the country’s top health agency has petitioned the U.S. Food and Drug Administration to revoke approval of the vaccine used in the United States

This Montreal man died of an aneurysm after waiting in the ER for six hours

A 39-year-old Montreal man died of an aneurysm after spending six hours in an emergency room before giving up and going home.

Thieves get a taste for cheese and butter amid surging prices

British Columbia business owner Joe Chaput will spend $5,500 a month on security guards during the holiday season and plans on upgrading his store's video camera system for around $5,000 more.

‘Kraven the Hunter’ flops while ‘Moana 2’ tops the box office again

The Spider-Man spinoff “Kraven the Hunter” got off to a disastrous start in North American theatres this weekend.

Jamie Foxx gets stitches after a glass is thrown at him during dinner in Beverly Hills

Jamie Foxx required stitches after getting hit in the face with a glass while celebrating his birthday at a restaurant in Beverly Hills, California.

Driver, passenger flee scene of fiery Burnaby crash

Two people fled the scene of a fiery crash in Metro Vancouver early Sunday morning, according to authorities.

U.S. agencies should use advanced technology to identify mysterious drones, Schumer says

After weeks of fear and bewilderment about the drones buzzing over parts of New York and New Jersey, U.S. Senator Chuck Schumer is urging the federal government to deploy better drone-tracking technology to identify and ultimately stop the airborne pests.