Scotiabank to eliminate tellers at some branches, including Carleton University

Scotiabank is eliminating tellers at some of its branches, including one at Carleton University, and switching to "advice services only."

In a letter to customers obtained by CTV News, Scotiabank says as of March 3, 2025, the branch inside the university's Paterson Hall will "no longer be offering over-the-counter cash services."

That includes taking out and depositing cash, making bill payments and foreign exchange cash transactions.

In the letter, Scotiabank says the change is due to the "increasing trend towards digital transactions and services" and that the move will "allow us to strengthen our focus on helping you reach your financial goals."

One automated banking machine will remain on site.

The closest full-service branch to Carleton is located at 828 Bank Street, about a 40-minute walk away.

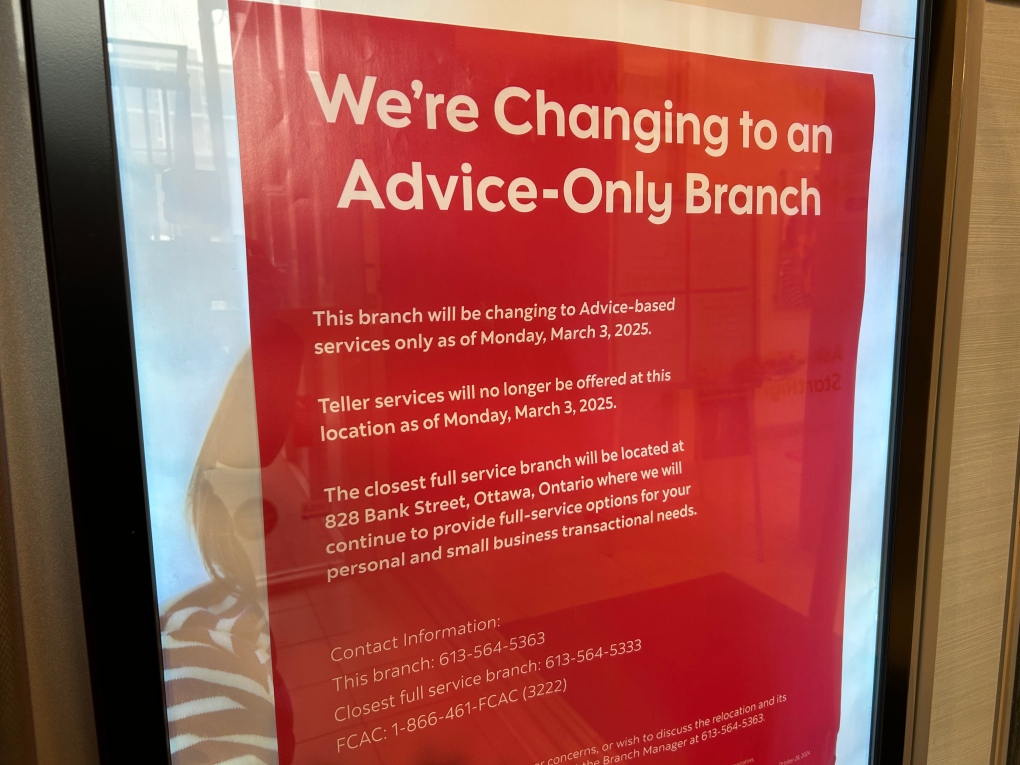

A sign in front of the Scotiabank branch on the campus of Carleton University. (Katie Griffin/CTV News Ottawa)

A sign in front of the Scotiabank branch on the campus of Carleton University. (Katie Griffin/CTV News Ottawa)

It's unclear how many branches in Ottawa are impacted and it's also unknown how many employees are affected by the change. At least one branch in Nova Scotia is also switching to an "advice-only" branch.

Students at Carleton University had mixed opinions about the decision on Monday. Some said they don't really see the need for tellers with online banking.

"I don't really go to tellers. Usually everything I need to do I can mostly do online," said student Grace Whiteland.

Other students said they value the in-person experience and services a teller provides.

"I can imagine it could be difficult for some people that want an in-person experience. They want to communicate with someone about their finances. Perhaps that might be even more beneficial with let's say, any international students," said another student, Matthew Singh.

"I think tellers are really useful if you want to change your bank account or update statements, maybe cash a cheque," said Ben Evensen."The use for tellers is needed but it'll be interesting to see what happens."

The letter states there will be no changes for those who have a safety deposit box. Small business and commercial customers using night deposit services will have to visit a full-service location.

Scotiabank did not say how many branches would be impacted and what might happen to affected employees.

"As a business, we continuously look at ways to innovate our services and better meet the evolving needs of our clients," Scotiabank said in a statement.

"As part of this evolution, we have adjusted the services offered at select branch locations to focus on advice services only, which includes financial advisor meetings, Small Business advisor services, support with online banking, and more."

Advice-focused branches will also be equipped with enhanced ABM's, the bank says, offering "multi-denominational bills and USD currency."

"Our advice focused branches are designed to help our clients reach their financial goals and work in collaboration with our full service branch locations. Our full service branches will continue to offer cash withdrawal, deposit and foreign exchange cash transactions, as will our automated banking machines (ABMs)."

Part of a wider trend

Some experts say the change is part of a wider trend in banking and other industries.

"We'll have less branches…that's insurance company branches, less bank branches, less post office branches because anything informational can be conducted digitally online," said Ian Lee, associate professor at the Sprott School of Business at Carleton University. Lee also worked at a bank for nine years.

"And so this is the trend we're witnessing. It's going to be a fundamental restructuring of the society in terms of employment."

This story will be updated

CTVNews.ca Top Stories

opinion Tom Mulcair: Prime Minister Justin Trudeau's train wreck of a final act

In his latest column for CTVNews.ca, former NDP leader and political analyst Tom Mulcair puts a spotlight on the 'spectacular failure' of Prime Minister Justin Trudeau's final act on the political stage.

B.C. mayor gets calls from across Canada about 'crazy' plan to recruit doctors

A British Columbia community's "out-of-the-box" plan to ease its family doctor shortage by hiring physicians as city employees is sparking interest from across Canada, says Colwood Mayor Doug Kobayashi.

'There’s no support': Domestic abuse survivor shares difficulties leaving her relationship

An Edmonton woman who tried to flee an abusive relationship ended up back where she started in part due to a lack of shelter space.

opinion King Charles' Christmas: Who's in and who's out this year?

Christmas 2024 is set to be a Christmas like no other for the Royal Family, says royal commentator Afua Hagan. King Charles III has initiated the most important and significant transformation of royal Christmas celebrations in decades.

Baseball Hall of Famer Rickey Henderson dead at 65, reports say

Rickey Henderson, a Baseball Hall of Famer and Major League Baseball’s all-time stolen bases leader, is dead at 65, according to multiple reports.

Arizona third-grader saves choking friend

An Arizona third-grader is being recognized by his local fire department after saving a friend from choking.

Germans mourn the 5 killed and 200 injured in the apparent attack on a Christmas market

Germans on Saturday mourned the victims of an apparent attack in which authorities say a doctor drove into a busy outdoor Christmas market, killing five people, injuring 200 others and shaking the public’s sense of security at what would otherwise be a time of joy.

Blake Lively accuses 'It Ends With Us' director Justin Baldoni of harassment and smear campaign

Blake Lively has accused her 'It Ends With Us' director and co-star Justin Baldoni of sexual harassment on the set of the movie and a subsequent effort to “destroy' her reputation in a legal complaint.

Oysters distributed in B.C., Alberta, Ontario recalled for norovirus contamination

The Canadian Food Inspection Agency has issued a recall due to possible norovirus contamination of certain oysters distributed in British Columbia, Alberta and Ontario.