OTTAWA -- Cold January temperatures could not cool down Ottawa's real estate market in January, as luxury home sales helped drive up home prices in the capital.

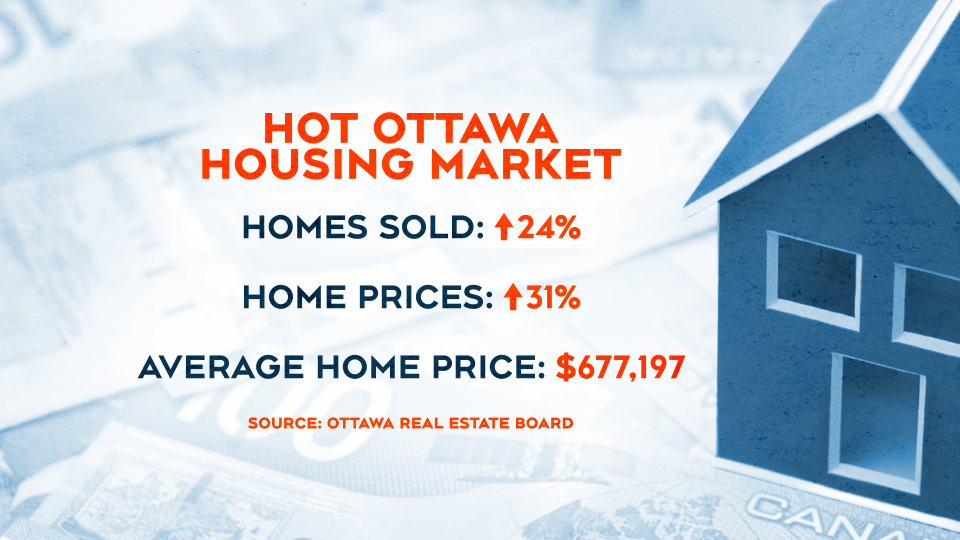

The Ottawa Real Estate Board says there was a 24 per cent increase in residential properties sold in January, while prices jumped 31 per cent compared to January 2020.

"Pent-up buyer demand fueled the exceptional number of sales that took place in January even as the mid-month lockdown further restricted supply," said Debra Wright, President of the Ottawa Real Estate Board.

Members of the Ottawa Real Estate Board sold 964 residential properties in January, compared with 778 in January 2020. Condominium sales were up 31 per cent in January, with 290 condo properties sold across Ottawa.

The average sale price for a residential-class property was $677,197 in January, up 31 per cent from a year ago. January's average sale price for a condominium was $380,336, up 13 per cent from last year.

Write says 63 homes sold for more than $1 million in January, which drove up the average sale price for homes in Ottawa.

"I would like to caution those looking at the increase in average prices this month and believing that property values are accelerating at an extreme pace. In January, there was considerable movement in the upper end of the market, which caused a bit of an anomalous outcome in average price percentages," said Wright.

"For example, there were 63 sales in the $1 million plus price range, while last year at this time, there were only 16 transactions. Sustained price movements are better reflected during the mid to latter part of the year, where trends begin to emerge, and comparisons can be drawn."

The Ottawa Real Estate Board does caution that the COVID-19 stay-at-home order could affect the real estate market through the winter and into the spring.

"Market activity has curtailed, there is no question about that, with January resale numbers lower than what we saw in December," said Wright. "But the effects of this second lockdown will not be entirely measurable until the coming months, dependent on when the mandated stay-at-home order is retracted. If the lockdown is extended, that could affect the market in the longer term; however, as we saw last year, the market was resilient throughout and is being driven by the needs of buyers and sellers."