Ottawa real estate values 2022 vs. 2018: Even those who missed boom have huge gains

If you are a homeowner who has spent a lot of time thinking "I could have listed" or "I should have sold" and you're feeling like you missed the epic real estate boom, realtor Taylor Bennett has a short pep-talk.

Bennett reassures homeowners here they can feel good about their real estate values.

“Ottawa is one of the most stable and predictable real estate markets in North America. Going back to the 1950s, the home prices in Ottawa increased by 6.75 per cent annually,” explains Bennett.

Instead of comparing 2022 values to 2020, Bennett suggests going back four years to look at the incredible growth since 2018.

And his main quote that bears repeating:

“While sales are down compared to last year, it's important to put the last year into context - 2021 was the best year for real estate, setting both sales and price records. So, a comparison to the best year on record is like comparing an NHL-ers season stats to Wayne Gretzky's best year. It's not going to look very successful. But when you pull back and take a broader look, we are currently on the same pace as we were in 2019 - the third best year on record.”

Taylor Bennett of Bennett Property Shop Realty, co-hosts the Bennett Real Estate and Wealth Show on Newstalk 580 CFRA and is a regular contributor on CTV Ottawa’s News at Noon.

“I thought we would give viewers a different perspective of the market and go back to 2020 and 2018 to see how quickly things have changed in four years,” says Bennett.

“The Ottawa real estate market is finally seeing signs of going back to 'old normal' - more inventory, fewer sales, and stable prices. But after over two years of record-setting prices and sales, where each month seemed to be better than the last, it's easy to forget how much the market has changed.”

TAYLOR BENNETT COMPARES JUNE OF 2022 TO JUNE OF 2018:

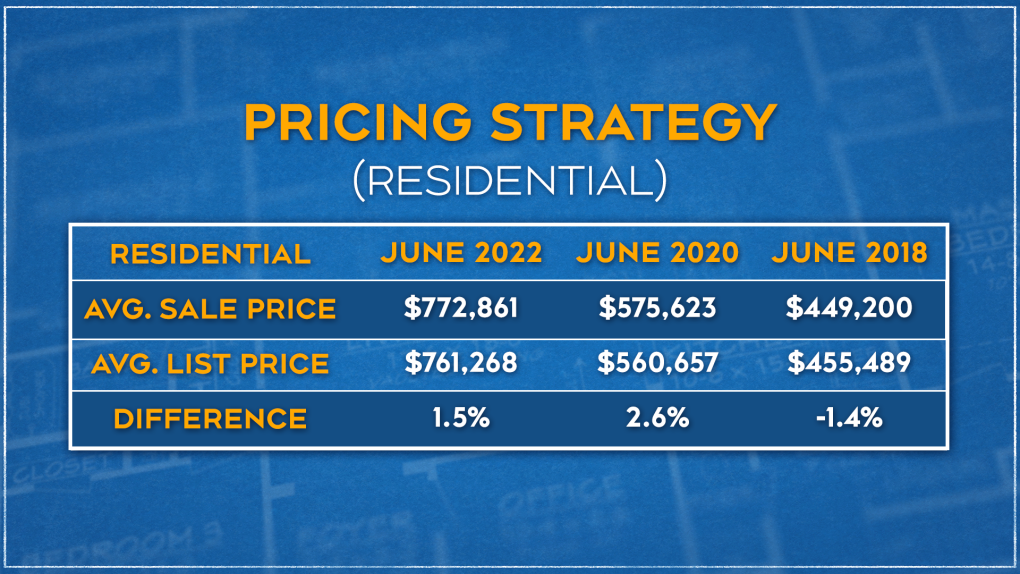

1. Pricing Strategy (residential)

“Residential homes have grown by over $300,000 in a four year window and almost $200,000 in two years,” Bennet says.

“One of the big reasons for this was the competitive multiple offer scenarios that were commonplace. These scenarios forced buyers to spend to the maximum of their budgets, whereas buyers in previous years could find options in the middle of their budgets. Additionally, the historically-low interest rates allowed for buyers' maximum budgets to be higher than in years past, resulting in the record-setting prices we have seen over the last two-plus years.”

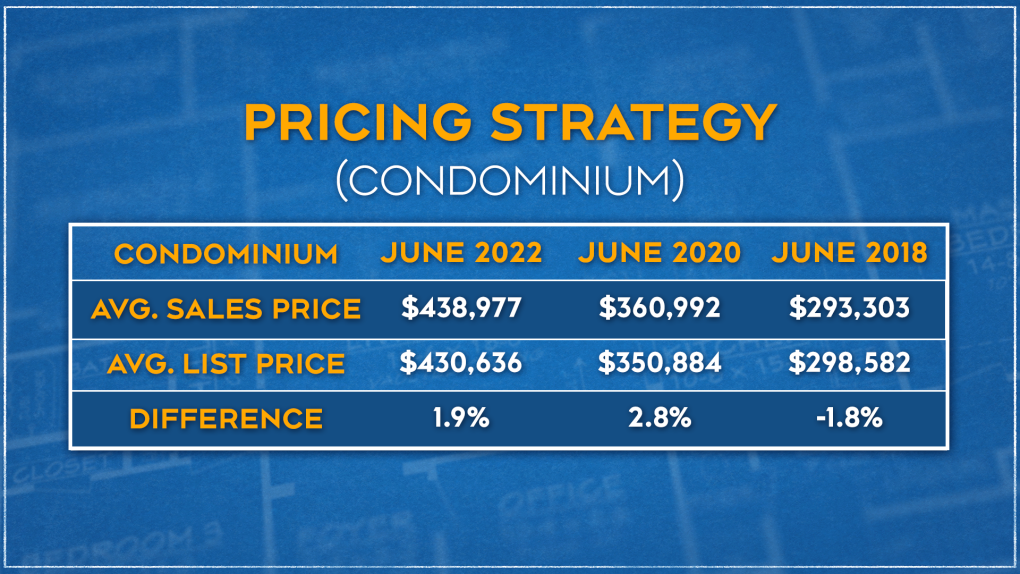

2. Pricing Strategy (condominium)

“The price for condominiums also grew substantially during the last four years, seeing the price increase by over $140,000 during that time,” Bennet explains. “And just like their residential counterparts, buyers were having to compete against multiple buyers - often having to outspend their competition to win. While the number of homes selling in multiple offers has drastically decreased - THAT is the norm. In 2018, and in many other years prior, most homes sold in one buyer vs one seller scenarios, and the sale prices typically ended up within one to two per cent of the list price - only since 2019, did we see the average sale price surpass the average list price.”

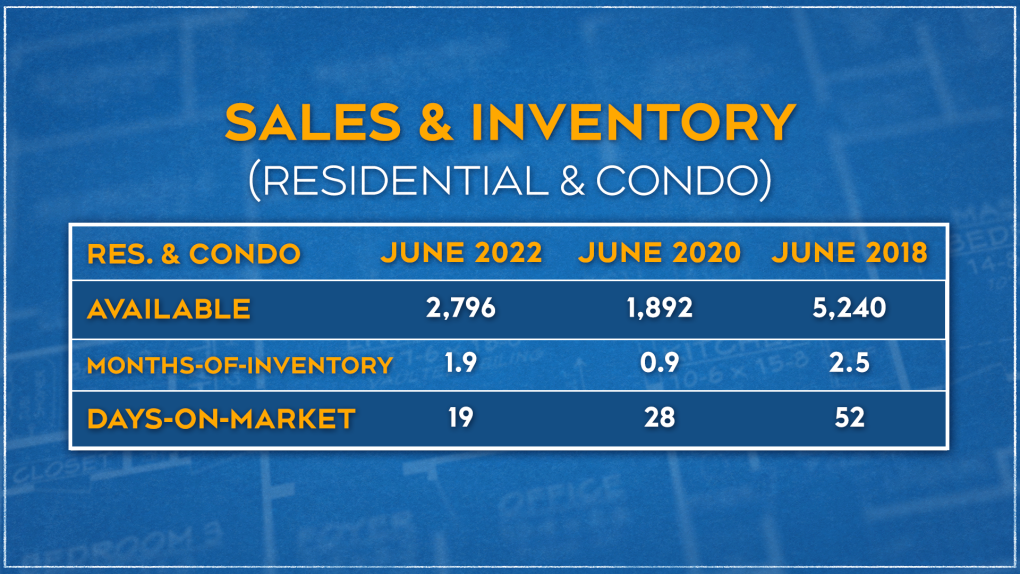

3. Sales & Inventory (residential & condo)

“One of the big factors contributing to the return to the ‘old normal’ is the increase in inventory - with more options for buyers to consider, not only are they able to shop around and find the best home, but they can now work in a condition or two into their offers, giving buyers more time to finalize their purchase,” says Bennett.

“Yet, even still, well-priced homes are still selling quickly - under 1 month, on average. Four years ago homes almost took 2 months to sell and inventory levels were almost double what they are today.”

4. Growth in Context

“Ottawa is one of the most stable and predictable real estate markets in North America. Going back to the 1950s, the home prices in Ottawa increased by 6.75% annually, and seldom did the market grow below two per cent or above ten per cent,” Bennet says.

“But, since 2019, we have seen the average sale price increase by over 50 per cent- or over 16 per cent per year, almost three times the average annual rate! With prices stabilizing we are seeing fewer record-setting sale prices, but compared to where home prices would normally be today, homeowners can still sell for almost $200,000 more than expected - well beyond any optimistic projections from 2018.”

CTVNews.ca Top Stories

Quebec fugitive killed in Mexican resort town, RCMP say

RCMP are confirming that a fugitive, Mathieu Belanger, wanted by Quebec provincial police has died in Mexico, in what local media are calling a murder.

Trump again calls to buy Greenland after eyeing Canada and the Panama Canal

First it was Canada, then the Panama Canal. Now, Donald Trump again wants Greenland. The president-elect is renewing unsuccessful calls he made during his first term for the U.S. to buy Greenland from Denmark, adding to the list of allied countries with which he's picking fights even before taking office.

Multiple OnlyFans accounts featured suspected child sex abuse, investigator reports

An experienced child exploitation investigator told Reuters he reported 26 accounts on the popular adults-only website OnlyFans to authorities, saying they appeared to contain sexual content featuring underage teen girls.

King Charles ends royal warrants for Ben & Jerry's owner Unilever and Cadbury chocolatiers

King Charles III has ended royal warrants for Cadbury and Unilever, which owns brands including Marmite and Ben & Jerry’s, in a blow to the household names.

'Serious safety issues': Edmonton building where security guard was killed evacuated

An apartment building where a security guard was killed earlier this month is being evacuated.

Santa Claus cleared for travel in Canadian airspace

Santa's sleigh has been cleared for travel in Canadian airspace, the federal government announced on Monday just ahead of the busy holiday season.

Ex-OpenAI engineer who raised legal concerns about the technology he helped build has died

Suchir Balaji, a former OpenAI engineer and whistleblower who helped train the artificial intelligence systems behind ChatGPT and later said he believed those practices violated copyright law, has died, according to his parents and San Francisco officials. He was 26.

U.S. House Ethics report finds evidence Matt Gaetz paid thousands for sex and drugs including paying a 17-year-old for sex in 2017

The U.S. House Ethics Committee found evidence that former Rep. Matt Gaetz paid tens of thousands of dollars to women for sex or drugs on at least 20 occasions, including paying a 17-year-old girl for sex in 2017, according to a final draft of the panel's report on the Florida Republican, obtained by CNN.

Young mammoth remains found nearly intact in Siberian permafrost

Researchers in Siberia are conducting tests on a juvenile mammoth whose remarkably well-preserved remains were discovered in thawing permafrost after more than 50,000 years.