An increasing number of seniors in Canada are carrying debt to the grave. No pension plan, unexpected costs, and even adult kids living at home are all part of a financial burden weighing down our elderly.

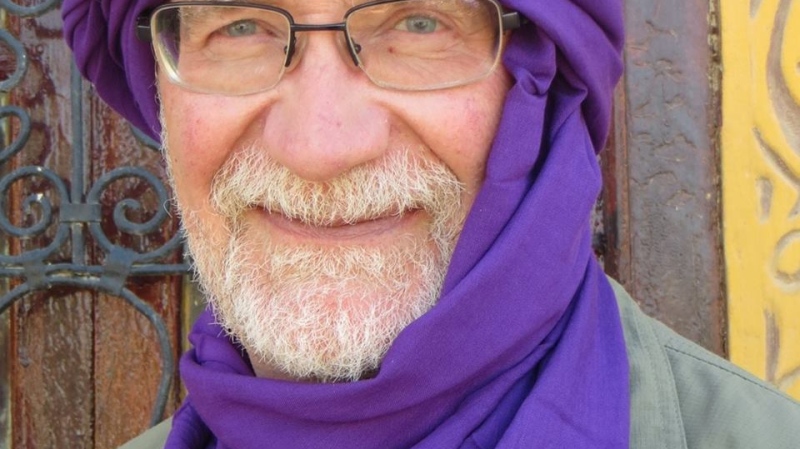

For many seniors, there's nothing golden about their retirement. In fact, a growing number are facing poverty in their old age. Today, experts from around the world gathered at Carleton University for a seniors' debt conference to take a hard look at a sensitive issue. The conference, entitled “Carrying Debt to the Grave? The increasing indebtedness of the elderly” was hosted by the Public Policy and Administration department of Carleton along with the Social Sciences and Humanities Research Council of Canada. The one-day conference was open to the public and 77-year-old Nyla Staulus decided to attend.

“I'm one of those seniors in debt,” she openly admits, “It was because of my desire to help my children, get them launched.”

Now Staulus is at this conference, trying to learn, as a senior, how to handle her growing debt.

“I try not to let it worry me because it's useless worry. If I’m not doing anything about it, it's useless to worry,” she says.

But it is worrisome. According to statistics from Jane Rooney with the Financial Consumer Agency of Canada, 19% of seniors still have mortgages to pay off, 15% have outstanding credit card debt and 18% of all personal bankruptcies involved people over the age of 60.

Laura Watts was one of the speakers at the one day conference. She is with the University of British Columbia’s Canadian Centre for Elder Law, “We are seeing boomers retiring with debt and not little bits of debt, significant debt,” she says, “People owe $1.6 dollar for every dollar they have in Canada. The problem is when you're an older person, you can't make that money back.”

In the U.S., the crisis is staggering. Deborah Thorne studies bankruptcy at the University of Idaho. She, too, spoke at the conference, “In the U.S. since 1991, there has been a fivefold increase in seniors over 65 filing for bankruptcy,” she says, and says there are a variety of reasons, including the collapse of the defined benefit pension plans and social safety nets.

“It's expensive to age,” she says, “We were talking about the increase in dementia, housing, limited fixed incomes in the States with especially health care costs. It’s dysfunctional and unmanageable.”

It's a world-wide crisis and that's what has brought the collective minds together at Carleton University for this seniors' debt conference.

Saul Schwartz with Carleton’s School of Public Policy and Administration was the moderator, “Older people not to need to be ashamed,” he says, “Most people are reluctant to discuss financial problems and they need to know this can happen to anyone and that they should seek out whatever help they can find in Canada.”

“What we need people to do is adjust spending habits, put aside a small amount of money so you have 4 to 6 months to pay mortgages or expenses in the event of crisis?” says Jane Rooney.

But here's the thing most Ontarians don't have any kind of emergency savings and no way to cope with an unexpected expense except by taking on more debt.

A new Ipsos Survey shows that only 34% of people could financially cope with a divorce, 35% could take on unexpected car repairs or a purchase and only 31% could afford to take 3 months off work due to an illness.

“Probably not,” says one young man in Ottawa’s Byward Market today, “most of my money goes towards rent, tuition, stuff like that.”

“Probably I would do the same,” another man adds, “because life is so hard.”

So we know that habits we learn as young people, we carry into our old age. That's why the experts at today’s conference say start when your kids are young, teaching them the importance of saving for their future while they can.