Homeowners to receive vacant unit tax info this week ahead of first declaration season

A vacant building in Ottawa. (Shaun Vardon/CTV News Ottawa)

A vacant building in Ottawa. (Shaun Vardon/CTV News Ottawa)

Homeowners in Ottawa will be getting notices this week to declare whether any of the properties they own are vacant.

Ottawa city council voted in March to impose a 1 per cent tax on vacant units in the city starting in 2023. Property owners will be required to submit annual declarations indicating the occupancy status of every home they own. Any property that has been vacant for more than 184 days in each calendar year will be taxed an extra 1 per cent.

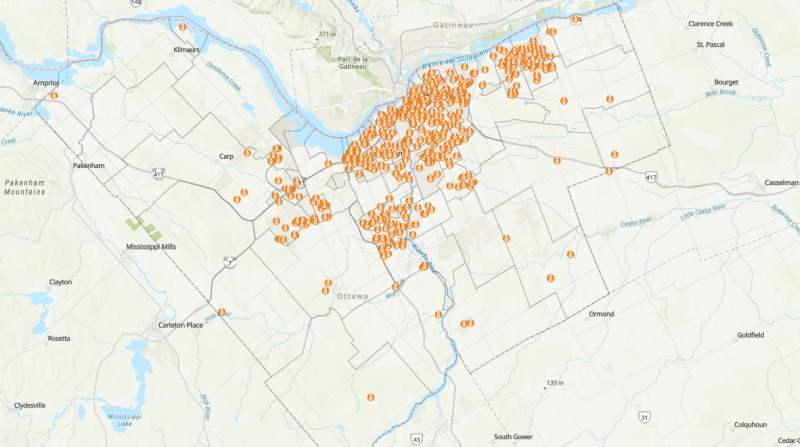

City staff estimate 330,000 residential property owners would need to declare their vacancy status annually.

Declaration letters and emails are going out this week with information on how to file the required occupancy status declaration for the 2022 calendar year.

Declarations must be filed between January and March 16, 2023. Property owners must provide some basic information on the occupancy of their property, including if it is their principal residence.

There are exceptions to ensure homes are not taxed unfairly. The vacant unit tax does not apply to primary residences. Other exemptions include:

- Death of a registered owner

- Property owner was in a hospital or long-term care facility

- Arm’s length sale of the property

- Specific court orders prohibiting occupancy, sale, or rental of the property

- Extended renovations or construction

- Was used as a cottage rental with a valid permit for at least 100 days

The city says vacant unit tax revenues will help fund affordable housing initiatives. City staff estimate the tax could raise approximately $25 million over five years. The tax is also meant to encourage occupancy in empty buildings to increase available housing stock.

CTVNews.ca Top Stories

Young people 'tortured' if stolen vehicle operations fail, Montreal police tell MPs

One day after a Montreal police officer fired gunshots at a suspect in a stolen vehicle, senior officers were telling parliamentarians that organized crime groups are recruiting people as young as 15 in the city to steal cars so that they can be shipped overseas.

Man sets self on fire outside New York court where Trump trial underway

A man set himself on fire on Friday outside the New York courthouse where Donald Trump's historic hush-money trial was taking place as jury selection wrapped up, but officials said he did not appear to have been targeting Trump.

Mandisa, Grammy award-winning 'American Idol' alum, dead at 47

Soulful gospel artist Mandisa, a Grammy-winning singer who got her start as a contestant on 'American Idol' in 2006, has died, according to a statement on her verified social media. She was 47.

Sask. father found guilty of withholding daughter to prevent her from getting COVID-19 vaccine

Michael Gordon Jackson, a Saskatchewan man accused of abducting his daughter to prevent her from getting a COVID-19 vaccine, has been found guilty for contravention of a custody order.

She set out to find a husband in a year. Then she matched with a guy on a dating app on the other side of the world

Scottish comedian Samantha Hannah was working on a comedy show about finding a husband when Toby Hunter came into her life. What happened next surprised them both.

Shivering for health: The myths and truths of ice baths explained

In a climate of social media-endorsed wellness rituals, plunging into cold water has promised to aid muscle recovery, enhance mental health and support immune system function. But the evidence of such benefits sits on thin ice, according to researchers.

'It could be catastrophic': Woman says natural supplement contained hidden painkiller drug

A Manitoba woman thought she found a miracle natural supplement, but said a hidden ingredient wreaked havoc on her health.

Manitoba mom praises quick-thinking fire department for freeing daughter stuck in playground equipment

A Manitoba mother is praising firefighters for their quick work in helping her daughter who got stuck at a playground in Lorette, Man.

The Body Shop Canada explores sale as demand outpaces inventory: court filing

The Body Shop Canada is exploring a sale as it struggles to get its hands on enough inventory to keep up with "robust" sales after announcing it would file for creditor protection and close 33 stores.