Here's how much you need to earn to buy a home in Ottawa this summer

Anyone looking to buy a home in Ottawa must have a six-figure income to purchase a property this summer.

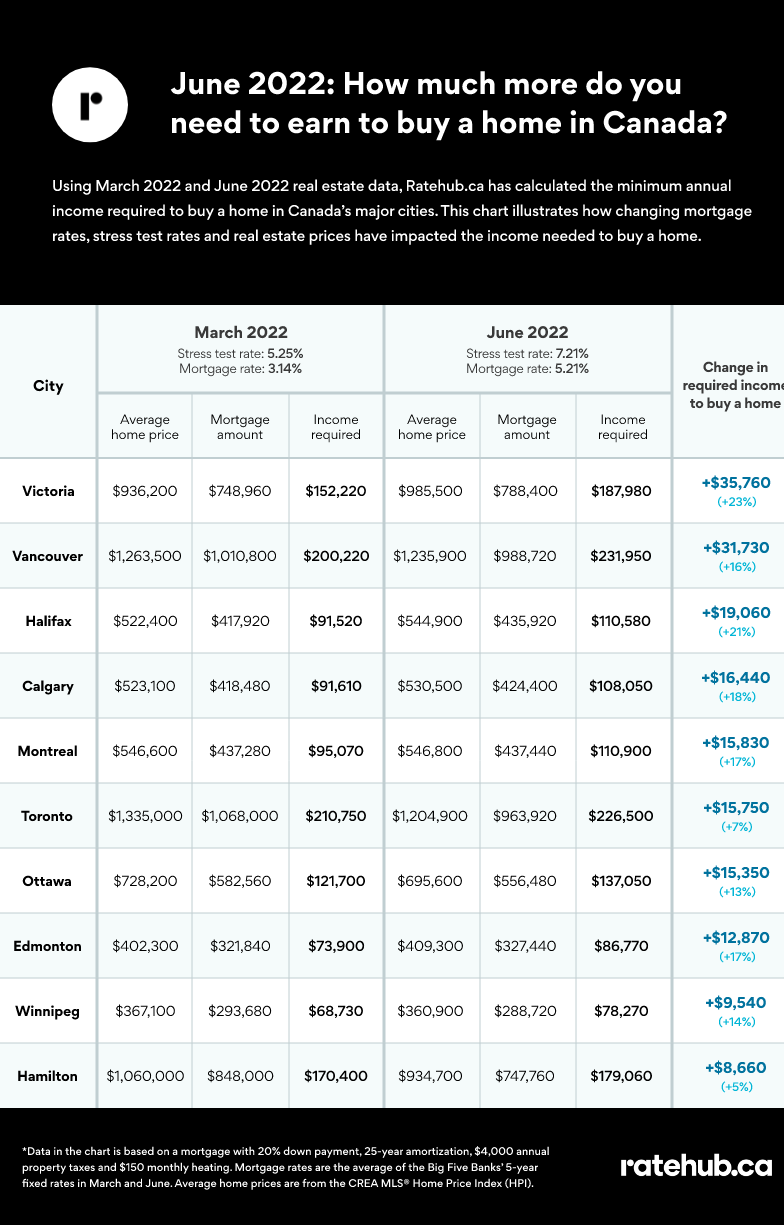

A new report from RateHub.ca shows homebuyers will need to earn at least $137,050 to meet the requirements to obtain a mortgage for the average priced home in the capital, with a 20 per cent down payment.

The report looked at the income required to purchase a home in Ottawa, with the average home price of $695,600 in June, and a mortgage of $556,480. The stress test rate was 7.21 per cent and the mortgage rate of 5.21 per cent.

Of the 10 Canadian cities looked at by RateHub.ca, Ottawa had the fifth-highest income requirement to purchase a home in June. Vancouver had the highest income requirement at $231,950, followed by Toronto ($226,500), Victoria ($187,980), and Hamilton ($179,060).

RateHub.ca says the income required to buy an average-priced home in Ottawa increased $15,350 from March to June.

The report from the mortgage rate comparison site says while the average price of a home in Ottawa was down in June from March, the income required to purchase a home remains higher due to stress test rates.

In March, homebuyers needed an income of $121,700 to purchase the average home in Ottawa of $728,000, according to RateHub.ca. The report notes the stress test rate and the mortgage rate were lower in March than in June.

"In every city, homebuyers require a lot more income to purchase the average home due to higher stress tests caused by increasing mortgage rates," RateHub.ca Co-CEO James Laird said in a statement.

Laird says home prices will need to drop significantly further to offset the effects of the higher stress test.

"Unless that happens, home affordability will continue to be negatively impacted by the current rising rate environment."

CTVNews.ca Top Stories

Trend Line Anger, pessimism towards federal government reach six-year high: Nanos survey

Most Canadians in March reported feeling angry or pessimistic towards the federal government than at any point in the last six years, according to a survey by Nanos Research.

B.C. child killer's lawyer walks out of review hearing

The lawyer representing child-killer Allan Schoenborn walked out of his client's annual review hearing Wednesday – abruptly ending proceedings marked by tense exchanges and several outbursts.

'A living nightmare': Winnipeg woman sentenced following campaign of harassment against man after online date

A Winnipeg woman was sentenced to house arrest after a single date with a man she met online culminated in her harassing him for years, and spurred false allegations which resulted in the innocent man being arrested three times.

How to avoid the trap of becoming 'house poor'

The journey to home ownership can be exciting, but personal finance columnist Christopher Liew warns about the trappings of becoming 'house poor' -- where an overwhelming portion of your income is devoured by housing costs. Liew offers some practical strategies to maintain better financial health while owning a home.

Juror dismissed in Trump hush money trial as prosecutors ask for former president to face contempt

Prosecutors in the hush money trial of Donald Trump asked Thursday for the former president to be held in contempt and fined because of seven social media posts that they said violated a judge's gag order barring him from attacking witnesses.

Why drivers in Ontario, Quebec and Atlantic Canada will see a gas price spike, and other Canadians won't

Drivers in Eastern Canada face a big increase in gas prices because of various factors, especially the higher cost of the summer blend, industry analysts say.

It's the biggest election in history. Here's why few Indians in Canada will take part

In the Indian general election that gets underway on Friday, almost a billion people are eligible to vote, but a vast majority of the overseas Indian community in Canada won't be casting a ballot.

McDonald's customers left with 'zero value' collection of free hot drink stickers after company ends program

It took years for Vinnie Deluca to collect more than 400 cards worth of free McDonald's McCafe coffee, a collection that now has "zero value" after the company discontinued the program.

Getting the lowest mortgage rates in a high interest rate world

The challenges facing home buyers mean it's all the more important to do research and negotiate on rates, mortgage experts say, though they also caution that there's more to focus on than just what looks like the cheapest upfront option.