A snapshot of the changing world of real estate

Real estate prices and the stratospheric sales that have dominated conversations and newscasts for the past two years are definitely slowing down.

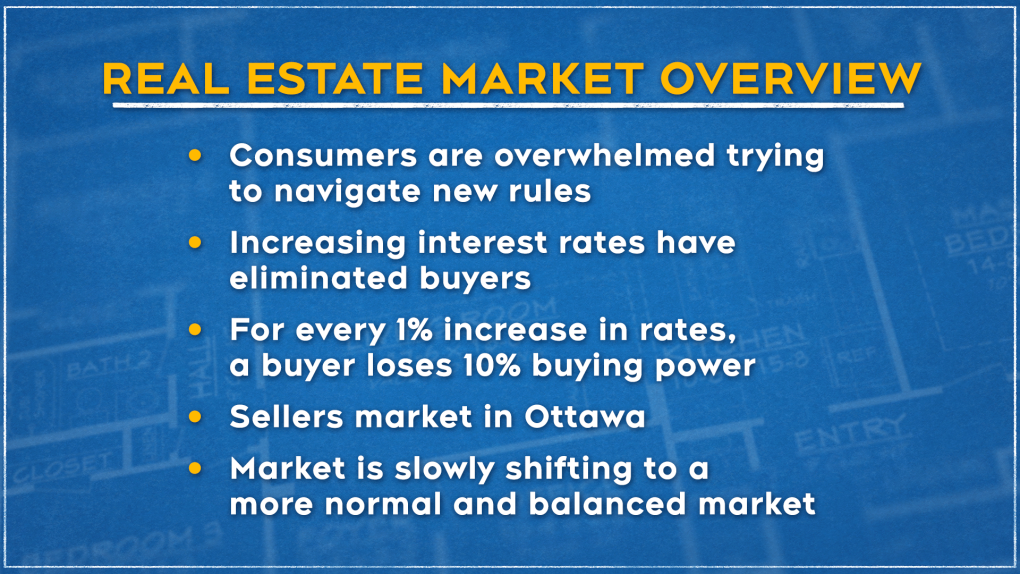

“The market is slowly shifting to a more normal and balanced market,” says Ottawa realtor and founder of Bennett Property Shop Realty, Marnie Bennett.

Higher interest rates are definitely a factor contributing to the cooling off, says Bennett.

The low rates created the wild ride for home buyers and those in the industry.

“These extremely low interest rates propelled homes prices more than 60 per cent over the last two years - record breaking sales across Canada,” Bennett explains.

“In the last two months, we have seen so many changes in the overall market. Consumers are overwhelmed and trying to navigate through all the new rules.”

Bennett says the increase in interest rates has eliminated many buyers, especially with another rate increase coming on June 1.

For every one per cent increase in rates, a buyer loses ten per cent buying power.

Bennett, who has been in the real estate business for more than four decades, thinks back to a dramatic time.

“In 1980, interest rates were 22 per cent. We are at 4.1 per cent right now with an added 2 per cent stress test qualifier.”

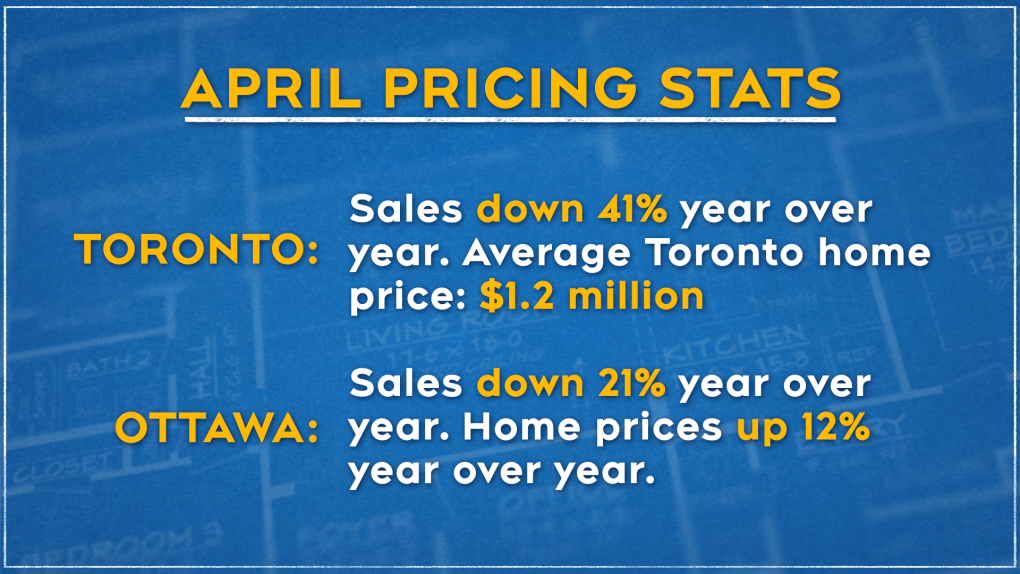

Bennett looks to the Toronto market for an overall picture.

“In Toronto, the largest real estate market in Canada, sales were down 41 per cent year-over-year.

“The sales price for homes in Toronto, as compared to March 2022 for the first time homes prices, were down by nine per cent in Toronto and, in the GTA, approximately seven to eight per cent.”

Bennett explores whether this is a trend or an aberration.

“Average Toronto home prices in March 2022 were $1.3 million. They dropped in April to $1.2 million for the average home,” Bennett says.

“Ottawa sales were down 21 per cent year-over-year, but prices were up in Ottawa year-over-year by 12 per cent.

“The housing market has been a major focus of the federal government and provincial governments over the last few months. Canada has a severe shortage of homes; approximately 3 million are needed.”

Bennett examines what is happening:

- Inflation percentage of 6 per cent is the highest on record in the last 30 years

- In Early 2020, the Bank of Canada dropped interest rates to nearly zero to cushion the economic blow of the pandemic

- These extremely low interest rates propelled homes prices more than 60 per cent over the last two years, with record breaking sales across Canada

- 48 per cent of millennials now own homes, 24 per cent of renters bought homes, when it is normally only 6 per cent

- Approximately 30 per cent of homes purchased in the last two years have been from investors

What is happening in Ottawa?

The average sales price in Ottawa for a residential home is $829,318, an increase of 11 per cent year over year. The average home price in March 2022 was $743,309, an increase of approximately $86,000 month-to-month.

The average sales price in Ottawa for a condominium apartment $473,702, up 11 per cent year-over-year. March 2022 Ottawa condo prices were $426,874, an increase of about $47,000.

OTTAWA NEIGHBOURHOOD PRICES APRIL 2022 VS APRIL 2021

- NEW EDINBURGH - Up 63.5% - $1,614,000

- ALTA VISTA - Up 42% - $1,070,806

- GREELY - Up 33% - $1,120,782

- HUNT CLUB - Up 29% - $877,715

- BARRHAVEN - Up 14% - $842,082

- STITTSVILLE - Up 11% - $916,000

- ORLEANS - Up 10% - $765,081

VALLEY TOWNS APRIL PRICES APRIL 2022 VS APRIL 2021

- ARNPRIOR - Up 14% - $606,500

- CARLETON PLACE - Up 21% - $707,000

- ALMONTE - Up 27% - $730,667

- ROCKLAND - Up 9% - $638,362

- KEMPTVILLE - Up 18% - $766,143

Bennett concludes, in a segment on CTV News at Noon, that it is still a seller’s market.

There is just over a month’s supply of inventory for sale in Ottawa.

There are about 1,800 homes are for sale in Ottawa. Five years ago, there were more than 6,000 for sale.

Bennett says sellers will have less qualified buyers to sell to and there will be few offers and fewer multiple offers.

“There will be conditional sales, and for less than asking, but homes that are updated and well-maintained will sell for more than asking.

“The market is slowly shifting to a more normal and balanced market.”

CTVNews.ca Top Stories

LIVE NOW Budget 2024 prioritizes housing while taxing highest earners, deficit projected at $39.8B

In an effort to level the playing field for young people, in the 2024 federal budget, the government is targeting Canada's highest earners with new taxes in order to help offset billions in new spending to enhance the country's housing supply and social supports.

BUDGET 2024 Feds cutting 5,000 public service jobs, looking to turn underused buildings into housing

Five thousand public service jobs will be cut over the next four years, while underused federal office buildings, Canada Post properties and the National Defence Medical Centre in Ottawa could be turned into new housing units, as the federal government looks to find billions of dollars in savings and boost the country's housing portfolio.

Some of the winners and losers in the 2024 federal budget

With a variety of fiscal and policy measures announced in the federal budget, winners include small businesses and fintech companies while losers include the tobacco industry and Canadian pension funds.

From housing initiatives to a disability benefit, how the federal budget impacts you

From plans to boost new housing stock, encourage small businesses, and increase taxes on Canada’s top-earners, CTVNews.ca has sifted through the 416-page budget to find out what will make the biggest difference to your pocketbook.

Liberals aim to hit the brakes on car theft with new criminal offences

The Liberals are proposing new charges for the use of violence while stealing a vehicle and for links to organized crime, as well as laundering money for the benefit of a criminal organization.

BUDGET 2024 Ottawa police get $50 million to boost security around Parliamentary Precinct

The Ottawa Police Service will receive $50 million in new federal funding over the next five years to "enhance security" around the Parliamentary Precinct.

Liberals to dole out five years worth of carbon rebates to businesses

Small- and medium-sized business owners are set to receive a long-awaited refund from Ottawa, which was holding onto billions of dollars while it sorted out a way to deliver them their carbon pricing rebates.

Feds offer $5B in Indigenous loan guarantees, fall $420B short on infrastructure asks

The federal government is providing up to $5 billion in loan guarantees to help Indigenous communities invest in natural resource and energy products. But when it comes to a promise to close what advocates say is a sprawling Indigenous infrastructure gap, Ottawa is short more than $420 billion.

BREAKING Police to announce arrests in Toronto Pearson airport gold heist

Police say that arrests have been made in connection with a $20-million gold heist at Toronto Pearson International Airport one year ago.