A snapshot of the changing world of real estate

Real estate prices and the stratospheric sales that have dominated conversations and newscasts for the past two years are definitely slowing down.

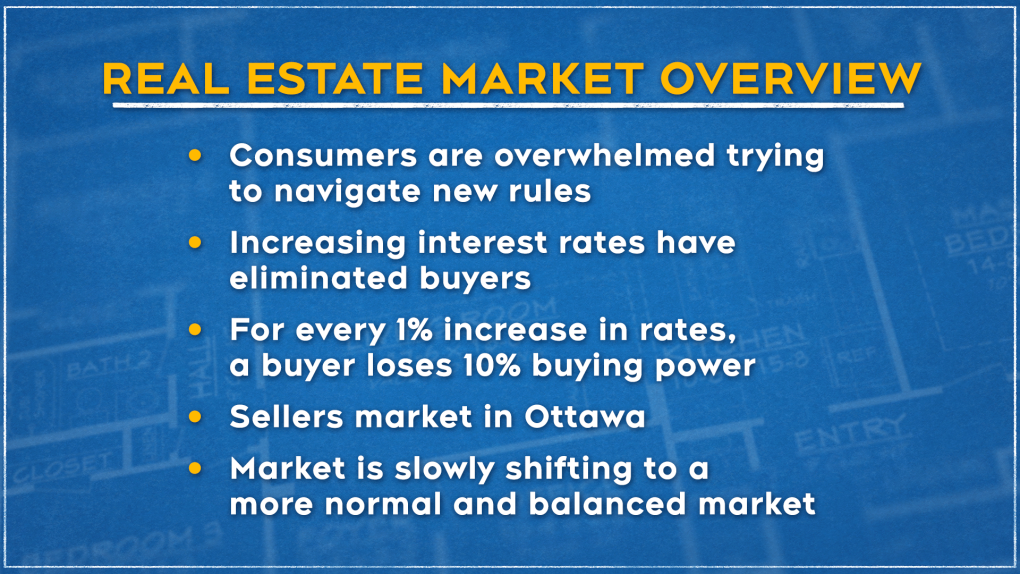

“The market is slowly shifting to a more normal and balanced market,” says Ottawa realtor and founder of Bennett Property Shop Realty, Marnie Bennett.

Higher interest rates are definitely a factor contributing to the cooling off, says Bennett.

The low rates created the wild ride for home buyers and those in the industry.

“These extremely low interest rates propelled homes prices more than 60 per cent over the last two years - record breaking sales across Canada,” Bennett explains.

“In the last two months, we have seen so many changes in the overall market. Consumers are overwhelmed and trying to navigate through all the new rules.”

Bennett says the increase in interest rates has eliminated many buyers, especially with another rate increase coming on June 1.

For every one per cent increase in rates, a buyer loses ten per cent buying power.

Bennett, who has been in the real estate business for more than four decades, thinks back to a dramatic time.

“In 1980, interest rates were 22 per cent. We are at 4.1 per cent right now with an added 2 per cent stress test qualifier.”

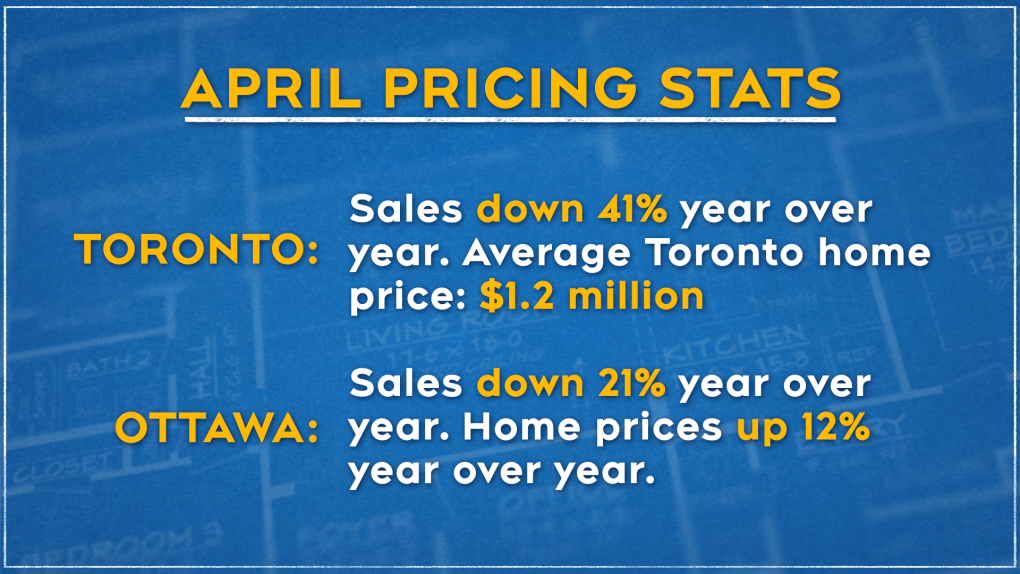

Bennett looks to the Toronto market for an overall picture.

“In Toronto, the largest real estate market in Canada, sales were down 41 per cent year-over-year.

“The sales price for homes in Toronto, as compared to March 2022 for the first time homes prices, were down by nine per cent in Toronto and, in the GTA, approximately seven to eight per cent.”

Bennett explores whether this is a trend or an aberration.

“Average Toronto home prices in March 2022 were $1.3 million. They dropped in April to $1.2 million for the average home,” Bennett says.

“Ottawa sales were down 21 per cent year-over-year, but prices were up in Ottawa year-over-year by 12 per cent.

“The housing market has been a major focus of the federal government and provincial governments over the last few months. Canada has a severe shortage of homes; approximately 3 million are needed.”

Bennett examines what is happening:

- Inflation percentage of 6 per cent is the highest on record in the last 30 years

- In Early 2020, the Bank of Canada dropped interest rates to nearly zero to cushion the economic blow of the pandemic

- These extremely low interest rates propelled homes prices more than 60 per cent over the last two years, with record breaking sales across Canada

- 48 per cent of millennials now own homes, 24 per cent of renters bought homes, when it is normally only 6 per cent

- Approximately 30 per cent of homes purchased in the last two years have been from investors

What is happening in Ottawa?

The average sales price in Ottawa for a residential home is $829,318, an increase of 11 per cent year over year. The average home price in March 2022 was $743,309, an increase of approximately $86,000 month-to-month.

The average sales price in Ottawa for a condominium apartment $473,702, up 11 per cent year-over-year. March 2022 Ottawa condo prices were $426,874, an increase of about $47,000.

OTTAWA NEIGHBOURHOOD PRICES APRIL 2022 VS APRIL 2021

- NEW EDINBURGH - Up 63.5% - $1,614,000

- ALTA VISTA - Up 42% - $1,070,806

- GREELY - Up 33% - $1,120,782

- HUNT CLUB - Up 29% - $877,715

- BARRHAVEN - Up 14% - $842,082

- STITTSVILLE - Up 11% - $916,000

- ORLEANS - Up 10% - $765,081

VALLEY TOWNS APRIL PRICES APRIL 2022 VS APRIL 2021

- ARNPRIOR - Up 14% - $606,500

- CARLETON PLACE - Up 21% - $707,000

- ALMONTE - Up 27% - $730,667

- ROCKLAND - Up 9% - $638,362

- KEMPTVILLE - Up 18% - $766,143

Bennett concludes, in a segment on CTV News at Noon, that it is still a seller’s market.

There is just over a month’s supply of inventory for sale in Ottawa.

There are about 1,800 homes are for sale in Ottawa. Five years ago, there were more than 6,000 for sale.

Bennett says sellers will have less qualified buyers to sell to and there will be few offers and fewer multiple offers.

“There will be conditional sales, and for less than asking, but homes that are updated and well-maintained will sell for more than asking.

“The market is slowly shifting to a more normal and balanced market.”

CTVNews.ca Top Stories

'They needed people inside Air Canada:' Police announce arrests in Pearson gold heist

Police say one former and one current employee of Air Canada are among the nine suspects that are facing charges in connection with the gold heist at Pearson International Airport last year.

House admonishes ArriveCan contractor in rare parliamentary show of power

MPs enacted an extraordinary, rarely used parliamentary power on Wednesday, summonsing an ArriveCan contractor to appear before the House of Commons where he was admonished publicly and forced to provide answers to the questions MPs said he'd previously evaded.

Leafs star Auston Matthews finishes season with 69 goals

Auston Matthews won't be joining the NHL's 70-goal club this season.

Trump lawyers say Stormy Daniels refused subpoena outside a Brooklyn bar, papers left 'at her feet'

Donald Trump's legal team says it tried serving Stormy Daniels a subpoena as she arrived for an event at a bar in Brooklyn last month, but the porn actor, who is expected to be a witness at the former president's criminal trial, refused to take it and walked away.

Why drivers in Eastern Canada could see big gas price spikes, and other Canadians won't

Drivers in Eastern Canada face a big increase in gas prices because of various factors, especially the higher cost of the summer blend, industry analysts say.

Doug Ford calls on Ontario Speaker to reverse Queen's Park keffiyeh ban

Ontario Premier Doug Ford is calling on Speaker Ted Arnott to reverse a ban on keffiyehs at Queen's Park, describing the move as “needlessly” divisive.

'A living nightmare': Winnipeg woman sentenced following campaign of harassment against man after online date

A Winnipeg woman was sentenced to house arrest after a single date with a man she met online culminated in her harassing him for years, and spurred false allegations which resulted in the innocent man being arrested three times.

Woman who pressured boyfriend to kill his ex in 2000s granted absences from prison

A woman who pressured her boyfriend into killing his teenage ex more than a decade ago will be allowed to leave prison for weeks at a time.

Customers disappointed after email listing $60K Tim Hortons prize sent in error

Several Tim Horton’s customers are feeling great disappointment after being told by the company that an email stating they won a boat worth nearly $60,000 was sent in error.