Ottawa's housing sales cooldown: Three months of double-digit decreases

The scorching hot Ottawa real estate market has cooled, but home values here are holding.

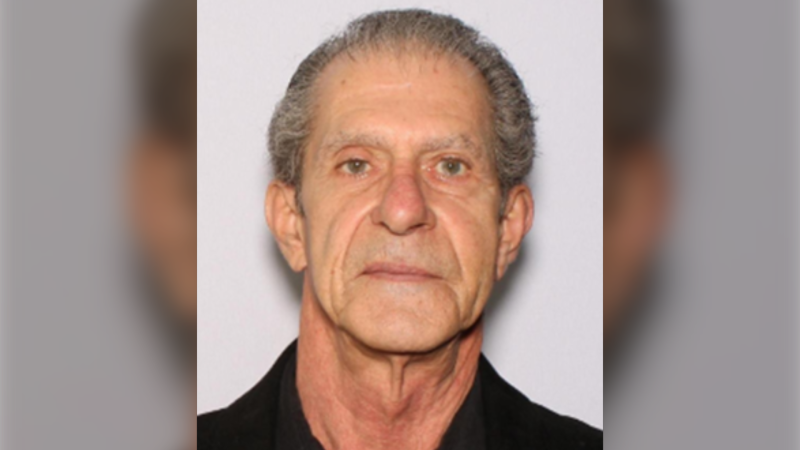

Marnie Bennett, who has been in the industry for more than four decades, says she is acting as part psychologist and economist as well as realtor right now with “managing expectations”.

She reassures everyone that industry growth has been a lottery win for homeowners, even with the cool down.

“The home equity growth that home sellers have experienced in in the last 2 years would traditionally take 10 to 12 years to realize.” explains Bennett.

“The market is cooling, but that cool down isn’t just a reality check. It’s a return to a more normal market. “

Bennett says double-digit price increases were unheard of in the city Ottawa.

“Based on historical data, over the last 70 years, Ottawa home prices increased on average 6.3 per cent annually in the core and 3.5 per cent annually in the outlying areas - the Ottawa Valley towns.”

COVID-19 created a whirlwind of home buying and the highest escalation of home prices on record.

“Renters and first time homebuyers raced to buy a home and this created price increases of up to 78 per cent since 2020,” says Bennett.

“After experiencing shocking sticker prices for homes and ‘free’ money with the lowest interest rates in the history of Canada. we are now returning to a normal real estate market.”

Bennett says homebuyers enjoyed the lowest interest ever offered in Canada at about 1.5 per cent.

“The result in the housing market is that home buyers are shell shocked about rising interest rates at over four per cent from only 1.5 per cent. Home sellers are having to appreciate that the joyride is over and that increased home prices are leveling off to normal increases,” says Bennett.

For long-term perspective she explains: “In 2002 for example interest rates were seven per cent and in the eighties they were ‘double-digit’ 18 per cent.”

“As a realtor we are having to educate both the homebuyer and the home seller about real estate cycles and that we are all adjusting now to normal times.”

Bennett says home sellers in Ottawa have not seen a decrease in prices but there is more competition and homes going on the market need to be in good repair and ready to sell.

“In this market with rising inventory of 168 per cent since January well cared for homes with top level presentation is necessary in order to sell.”

This is a positive for buyers out there as there is more choice and that prices are negotiable and terms.

“This has all happened very quickly and in some areas we are headed towards a buyers market.”

For the third straight month there have been double digit decreases in home sales in Ottawa.

“There are many factors—rising interest rates, the increased cost of living and inflation,” says Bennett. “Lifestyles are changing. People can enjoy more travel and entertainment.”

“There are many factors—rising interest rates, the increased cost of living and inflation,” says Bennett. “Lifestyles are changing. People can enjoy more travel and entertainment.”

“These are the first time homebuyers. Higher interest rates and the stress test are causing this slow down.”

The lower values are year over year and do not factor in the astronomical growth from 2020 to 2021.

The lower values are year over year and do not factor in the astronomical growth from 2020 to 2021.

When asked about the price decrease in Manotick, Bennett explains this could be an anomaly but will be closely watched.

“In Manotick it could be that in the month of May there were fewer waterfront properties sold. They are in the $2-million dollar range so that skews the numbers. We will see what June does. We will monitor this.”

CTVNews.ca Top Stories

Poilievre will do 'anything to win,' must condemn Alex Jones endorsement: Trudeau

Prime Minister Justin Trudeau is ramping up his attacks on Conservative Leader Pierre Poilievre as he promotes his government's federal budget.

'My stomach dropped': Winnipeg man speaks out after being criminally harassed following single online date

A Winnipeg man said a single date gone wrong led to years of criminal harassment, false arrests, stress and depression.

New evidence challenges the Pentagon's account of a horrific attack as the U.S. withdrew from Afghanistan: CNN exclusive

New video evidence uncovered by CNN significantly undermines two Pentagon investigations into an ISIS-K suicide attack outside Kabul airport, during the American withdrawal from Afghanistan in 2021.

'One of the single most terrifying things ever': Ontario couple among passengers on sinking tour boat in Dominican Republic

A Toronto couple are speaking out about their 'extremely dangerous' experience on board a sinking tour boat in the Dominican Republic last week.

All Alberta wildfires to date in 2024 believed to be human-caused: province

There are 63 wildfires burning in Alberta's forest protection area as of Wednesday morning and seven mutual aid fires, including one in the Municipal District of Peace.

Suspects waving weapons, smashing glass in Toronto jewelry store robbery caught on video

Arrests have been made after five men were captured on video rampaging through a jewelry store in Toronto, waving weapons and smashing glass display cases.

Pilot proposes to flight attendant girlfriend in front of passengers

A Polish pilot proposed to his flight attendant girlfriend during a flight from Warsaw to Krakow, and she said yes.

Ottawa injects another $36M into fund for those seriously injured or killed by vaccines

The federal government has added $36.4 million to a program designed to support people who have been seriously injured or killed by vaccines since the end of 2020.

Ex-SNC executive sentenced to prison term in bridge bribery case

The RCMP says a former SNC-Lavalin executive has been sentenced to three and a half years in prison in connection with a bribery scheme for a bridge repair contract in Montreal.